This past Summer, Congress passed a $300 billion housing bill to rescue Freddie Mac and Fannie Mae and to help thousands of homeowners avert foreclosure.

The housing bill should definitely help the volatile housing and financing markets.

At the time, the housing bill was record breaking landmark legislation. But, Oh my how much has changed in 2008:

Largest US bank failure – Washington Mutual, $307 billion in assets.

Federal Reserve intervenes to save investment bank giant “Bear Stearns”. JP Morgan bank takes over Bear Stearns and receives $29 billion dollar loan from government.

IndyMac bank failure $32 billion in assets.

U.S. Government to take over failed AIG in $85 billion bailout.

In October, the new, largest government bailout in history to help US banks – $700 billion dollars.

There has been so much that has happened in the past 5-6 months that is easy to forget about one of the most beneficial aspects of the $300 billion bailout in July. The $7,500 tax credit is a great benefit for 1st time home buyers.

Here is everything you need to know:

Eligibility:

- Purchase a home between April 9, 2008 and June 30, 2009.

- Must be a first time homeowner or haven’t owned a home in the last 3 years.

- New home purchase must be your principle residence.

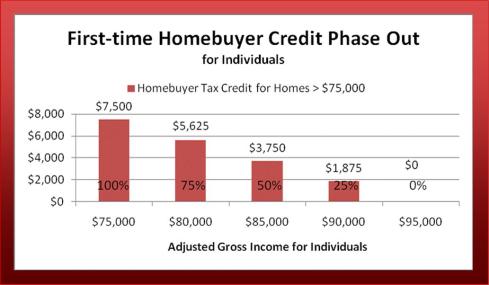

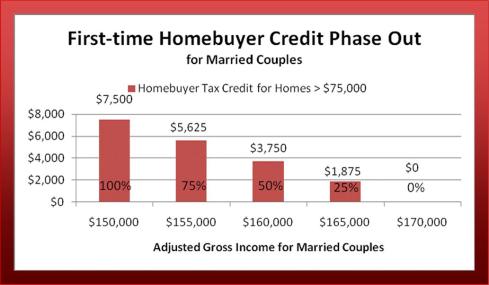

- Maximum income requirements (Adjusted Gross Income) for full $7500 tax credit benefit is $75,000 for individuals and $150,000 for married couples.

- Partial tax credit benefit eligible for adjusted gross incomes up to $95,000 for individuals and $170,000 for married couples (see phase out charts below)

Terms:

- $7,500 tax credit is basically an interest free loan from Uncle Sam.

- There is no application or approval process.

- If you are eligible, you simply claim the tax credit when you do your 2008 or 2009 taxes (IRS form 1040).

- Payment starts 2 years after you apply for the credit.

- Those qualifying for the full $7,500 tax credit will pay $500 once a year for 15 years.

- If you receive less than the full credit your payment schedule will be 6.67% per year over 15 years.

- Payment will be done via completing your federal tax return every year.

- You will owe nothing if you lose money on the sale of your home. Also, regardless of the sale price, you will never have to pay money “out of your pocket”. Here are 3 good examples that will better explain everything:

- Purchased a $200,000 home, sold 4 years later for $204,000. At time of sale you still owed $6,500 on tax credit. You would just have to pay $4,000. The remaining $2,500 would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $199,999. At time of sale you still owed $6,500 on tax credit. You lost money on your home purchase. The entire remaining $6,500 balance would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $225,000. At time of sale you still owed $6,500 on tax credit. You are responsible to pay the full $6,500 remaining balance.

Basic Q&A’s:

- Are there restrictions on the location of the property? Yes, property must be located in the United States. Property outside the US is not eligible for the tax credit.

- Are there restrictions related to the financing of the property? Yes, if your financing is obtained via a mortgage revenue bond (example; a tax exempt bond related program from a state housing agency) then you will NOT be eligible for tax credit.

- Are there any other types of financing restrictions? No, all types of mortgage finance programs are eligible. For example; Conventional, FHA, VA, cash, sub-prime (boo hiss), non-conforming, etc. Even cash purchases qualify as long as purchaser meets all other eligibility requirements listed above.

- Are there minimum or maximum home purchase prices? No, maximum home purchase price for tax credit. Homes purchased under $75,000 will only receive 10% tax credit. For example, Buyer purchases a $50,000 condo. The maximum tax credit will be $5,000.

- What types of housing qualifies for tax credit? All types of home ownership qualifies. For example, condos, co-ops, existing single family, new builds, manufactured homes, town homes, duplexes even houseboats!

- What happens if I sell my home within 15 years? You are not reading my post. You are just “skimming” the article. Review the last bullet point in terms section above.

I think the $7,500 tax credit is a great benefit for the first time homeowner. If you meet eligibility requirements then you should really take advantage of this tax credit.

But, some home owners would say “What’s the big deal? I still need to pay pay back the $7,500!” I would tell you there are 2 very important things to consider:

- Basic economic principle called the “time value of money”. Money now is more valuable than money in the future. This principle is especially true now in this bad economy. Cash is King!. So, I guess my bachelors degree in Finance from the great Ohio State University was worthwhile.

- A tax credit is more valuable than a tax deduction. A credit affects the tax amount you owe or refund amount dollar for dollar. A tax deduction just reduces your adjusted income that is taxable.

IMPORTANT: I’m just trying to help the “average Joe home owner” understand the $7,500 tax credit. I have to put this CYA disclaimer in my post. Please consult a tax professional for more details and eligibility questions regarding the $7,500 1st time home owner tax credit. I’m not an accountant or tax professional.

Good luck out there

6 comments

Comments feed for this article

February 7, 2009 at 6:12 pm

Michael

Michelle,

Thank you for your comments.

Q1: Yes, It should have been $2,500. Thank you for point out the typo.

Q2: The remaining amount is forgiven because at the time you sell your home you are only required to pay back the current amount due on your tax credit or the amount of your net profit/equity whichever is LESS. Your net profit is determined by sales price minus your original purchase price.

Again, you should always check with your tax accountant or preparer.

Lastly, The new Feb. 2009 stimulus bill might change everything.

February 5, 2009 at 12:49 pm

Michelle

I have two questions regarding your first example:

“Purchased a $200,000 home, sold 4 years later for $204,000. At time of sale you still owed $6,500 on tax credit. You would just have to pay $4,000. The remaining $1,500 would be forgiven.”

Q1: Did you mean that the remaining $2,500 would be forgiven? ($6,500-$4,000 = $2,500)

Q2: Why would the remaining amount be forgiven?

November 3, 2008 at 6:26 pm

» $7500 Tax Credit For First Time Homebuyer « Homebuyer’s Advocate!

[…] Real opinions & quick, valuable information for the homebuyer in Central Ohio. More […]